Top High-Yield Savings Accounts for Maximum Returns in 2025

A high-yield savings account (HYSA) offers significantly higher interest rates than traditional savings accounts, typically ranging from 4.00% to 5.00% APY compared to the standard 0.40%. These accounts provide a low-risk way to grow your money while maintaining easy access to your funds.

How High-Yield Savings Accounts Work:

- Deposit funds and earn interest based on your balance

- Interest compounds daily or monthly

- Withdraw funds easily (usually limited to 6 withdrawals per month)

- FDIC-insured up to $250,000

Money jar with growing plants

Factors Affecting Interest Rates:

- Federal Reserve policies

- Economic conditions

- Bank competition

- Operating costs (online vs. traditional banks)

Growth chart with stacked coins

Key Features to Consider:

- Competitive APY rates

- Minimum balance requirements

- Monthly maintenance fees

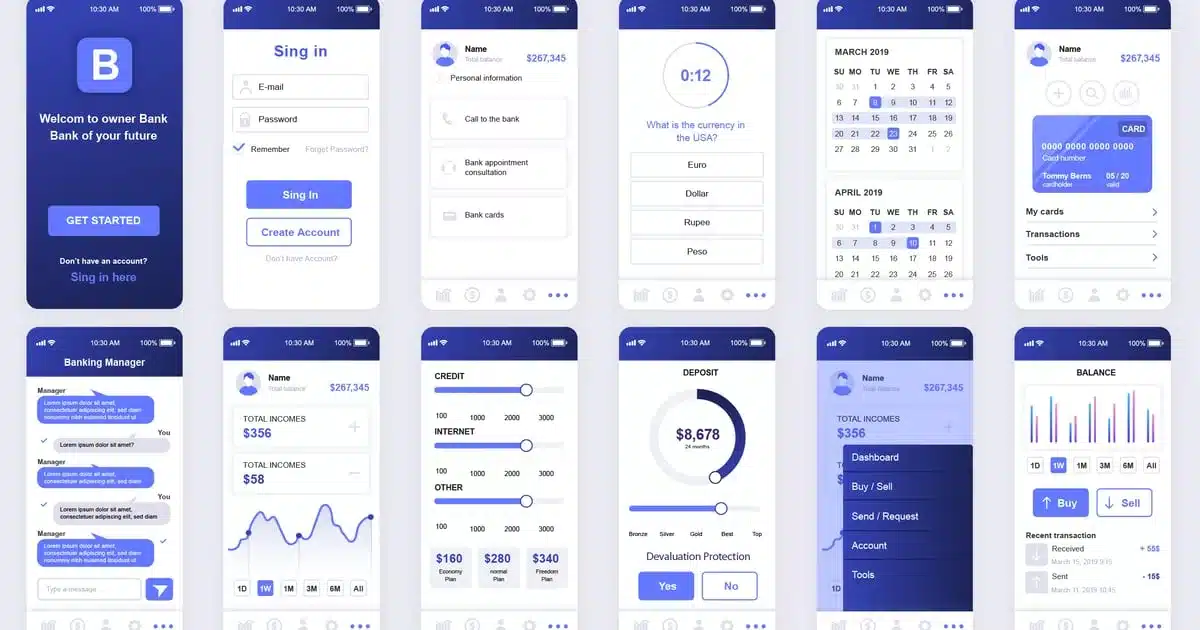

- Mobile banking capabilities

- Customer service options

High-yield savings rates comparison chart

Online vs. Traditional Banks:

- Online banks typically offer higher rates due to lower overhead costs

- Traditional banks provide in-person services and broader product offerings

Mobile banking vs traditional banking

Choosing the Right Account:

- Compare APYs across multiple banks

- Check for hidden fees

- Verify FDIC insurance

- Review withdrawal limits

- Assess online banking features

Phone displaying savings account interface

Steps to Open an Account:

- Research and compare options

- Select a bank that matches your needs

- Complete online application

- Fund your account

- Set up automatic deposits (optional)

Ideal for:

- Emergency funds

- Short-term savings goals

- Risk-averse savers

- Those seeking better returns than traditional savings accounts

A high-yield savings account offers a secure way to grow your money while maintaining liquidity. Choose an account with competitive rates, minimal fees, and features that align with your financial goals.