Superstruct Entertainment Secures CVC Investment to Fuel Live Entertainment Growth, KKR Remains Key Partner

Superstruct Entertainment has secured a significant investment from CVC Capital Partners, joining forces with KKR who acquired the company for approximately $1.4 billion in June. This development marks a new chapter for the European concert giant's growth in the live entertainment sector.

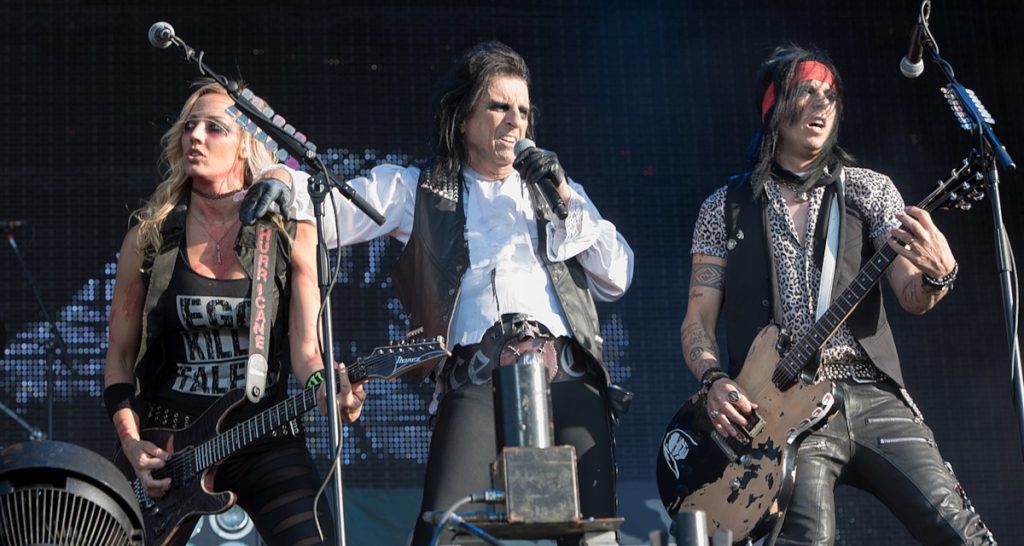

Alice Cooper performs at Wacken Festival

Superstruct, established in 2017, operates more than 80 festivals across 10 countries, including prominent events like Wacken Open Air and Tinderbox. While specific financial details of CVC's investment remain undisclosed, the partnership aims to enhance Superstruct's capacity to create premium live entertainment experiences.

CVC, which manages over $200 billion in assets, brings valuable expertise through its diverse portfolio, including investments in digital marketing, Authentic Brands Group, and travel agencies. The firm plans to work closely with creative professionals and entrepreneurs to drive innovation in live entertainment.

This investment comes amid significant movement in the live entertainment sector, despite challenges such as festival attendance concerns and Festicket's collapse. Other notable industry developments include:

- CTS Eventim's $330 million acquisition of Vivendi's ticketing and festival assets

- Substantial investments in ticketing platforms like TickPick and Seat Unique

- Dice's potential sale exploration with a valuation in the hundreds of millions

- StubHub's planned $16.5 billion IPO remains in consideration

The partnership between KKR and CVC positions Superstruct to strengthen its market presence while pursuing innovative approaches to live entertainment experiences.

Related Articles

Apple TV+ Loses Over $1 Billion Per Year Despite Growing Subscriber Base