Spotify Stock Soars 115% in 12 Months - Can SPOT Maintain Its Record-Breaking Growth in 2024?

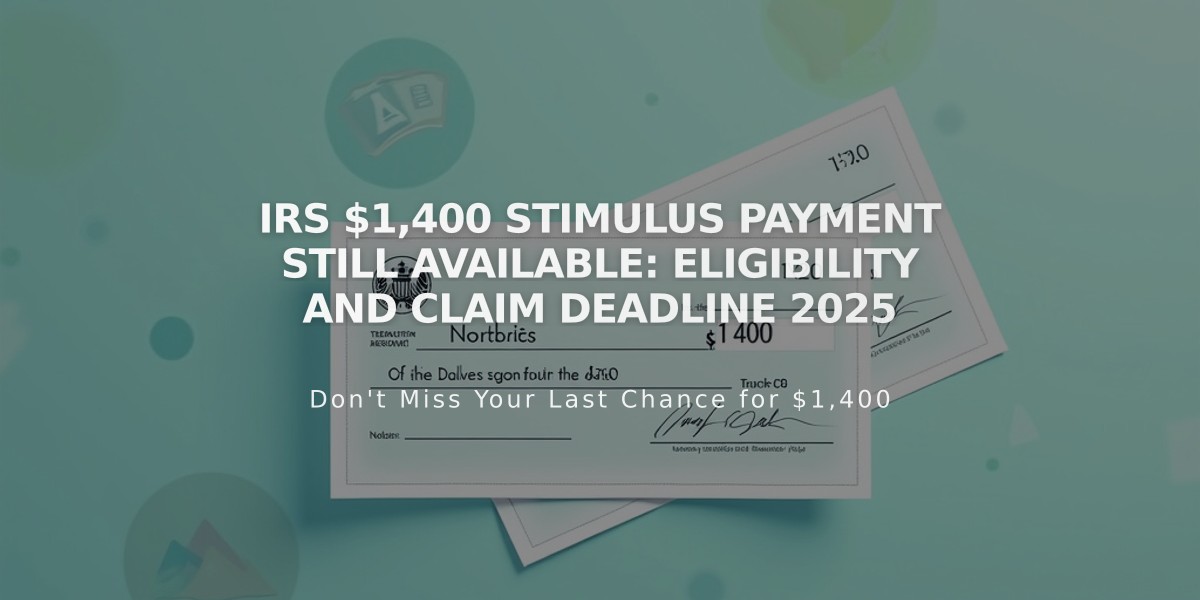

Spotify stock (NYSE: SPOT) has demonstrated remarkable strength in early 2024, despite a recent 3% dip in trading. Currently trading at $197.71 per share, the stock has gained nearly 5% since the year's start and achieved an impressive 115% increase over the past 12 months.

Spotify stock price line chart

Key Performance Indicators:

- Outperforming peer average by 1112.3% year-to-date

- Exceeding peer average by 177.1% over 12 months

- Trading volume up 30% compared to 20-day average

- Market cap exceeding $38.5 billion

- Analysts project 5% growth for 2024

Recent Strategic Shifts:

- Significant workforce reduction (20% of staff laid off)

- Focus shift towards consistent profitability

- Moving away from acquisition-heavy strategy

Critical Factors for 2024 Performance:

- Ability to maintain consistent profitability

- Upcoming Q4 2023 financial results (February 6th)

- Potential renewal of Joe Rogan podcast deal (previous deal valued at $200 million)

- Ongoing search for permanent CFO

CEO Daniel Ek has committed to maintaining profitability going forward, though recent layoffs will incur significant one-time expenses. The company's performance through 2024 will likely depend heavily on its ability to balance cost-cutting measures with strategic investments, particularly regarding high-value content partnerships like The Joe Rogan Experience, which remains Spotify's most popular podcast.

Live Nation logo with concert audience

Related Articles

Mega Millions Announces Major Overhaul: $5 Tickets and Higher Jackpots Coming in April