Private Equity Firms Show Strong Interest in Potential Vivid Seats Takeover Amid Live Entertainment Boom

Vivid Seats, a major ticketing platform, is reportedly attracting takeover interest from private equity firms, highlighting continued investor enthusiasm in the live entertainment sector.

The company, which went public through a SPAC merger in 2021, has seen its stock price rise approximately 36% in the past month to $4.60 per share, though this remains 28% below 2024 levels. The recent price increase appears largely driven by sale speculation rather than fundamental performance.

People throwing money at concert crowd

Financial Performance and Investor Activity:

- Q3 2024 revenue: $186.61 million (slight YoY decrease)

- Concert ticket revenue: $67.70 million (22% YoY decline)

- Theater ticket revenue: $28.71 million (nearly doubled)

- Notable investor movements include Barclays increasing its stake by 350% to 125,163 shares

- Geode Capital Management expanded holdings by 18.9% to 1.98 million shares

Broader Industry Context:

- Recent major investments in ticketing platforms:

- Seat Unique: $19.1 million extended Series A

- TickPick: $250 million growth investment

- StubHub: Explored $16.5 billion IPO (temporarily shelved)

- Dice: Explored sale valuing hundreds of millions

The potential Vivid Seats sale reflects broader industry trends, with significant investment activity in live entertainment and ticketing despite Ticketmaster's market dominance. International expansion continues, as demonstrated by CTS Eventim's record performance following its See Tickets acquisition.

Neon Boiler Room sign

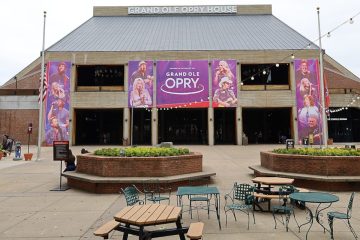

Opry House exterior at night