Marshall Group Acquired by HongShan Capital in $1.16 Billion Deal to Expand Global Reach

Marshall Group has been acquired by HongShan Capital Group (HSG) in a major deal valued at $1.16 billion (€1.1 billion). The Marshall family will retain approximately 20% ownership, while previous investors including Altor, Telia, Time for Growth, and Zenith VC will exit their positions.

Marshall Guitar Amplifier

This acquisition represents HSG's largest European investment to date. The Hong Kong-based company, which holds stakes in tech giants like Alibaba and ByteDance, aims to expand Marshall's global presence.

Key Details of the Acquisition:

- Valuation: $1.16 billion (€1.1 billion)

- Marshall family retention: ~20%

- Current revenue: Over $420 million (€400 million)

- Recent performance: Q3 2024 saw $102.43 million in net sales (15% YoY growth)

Marshall Group, with approximately 800 employees, consolidated its operations in 2023, bringing together its amplifier division, Bluetooth speakers, headphones, and artist services under one umbrella. The company has experienced significant growth, more than doubling its revenue between 2020 and 2024.

Marshall CEO Jeremy de Maillard expressed optimism about the deal, stating it creates "perfect conditions to continue building on Marshall's iconic status and unlocking our full potential across the world."

The acquisition aligns with growing music industry interest in the Asian market, following recent moves by major players like Live Nation, Believe, and Universal Music Group in the region.

The deal remains subject to regulatory approval.

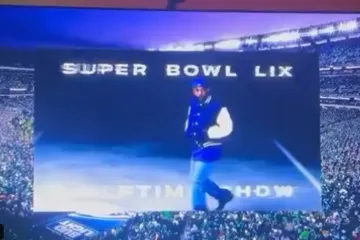

Kendrick Lamar performing at Super Bowl

Spotify music genres and mood categories