Bitcoin Hits $85,000 as Market Volatility Keeps Traders on Edge

Bitcoin has surged to $85,000 on March 14, 2025, marking a significant rebound from recent $80,000 levels. This comes after January's all-time high of $109,071 and subsequent 25% decline, highlighting the market's persistent volatility.

Bitcoin coins atop dollar bills

Multiple factors are influencing Bitcoin's price movements:

- Institutional interest continues to grow

- Macroeconomic concerns, including inflation

- Central bank policies affecting market sentiment

- Speculation about potential rises to $90,000 or $150,000

- Josh Mandell's accurate prediction of $84,000 for this date

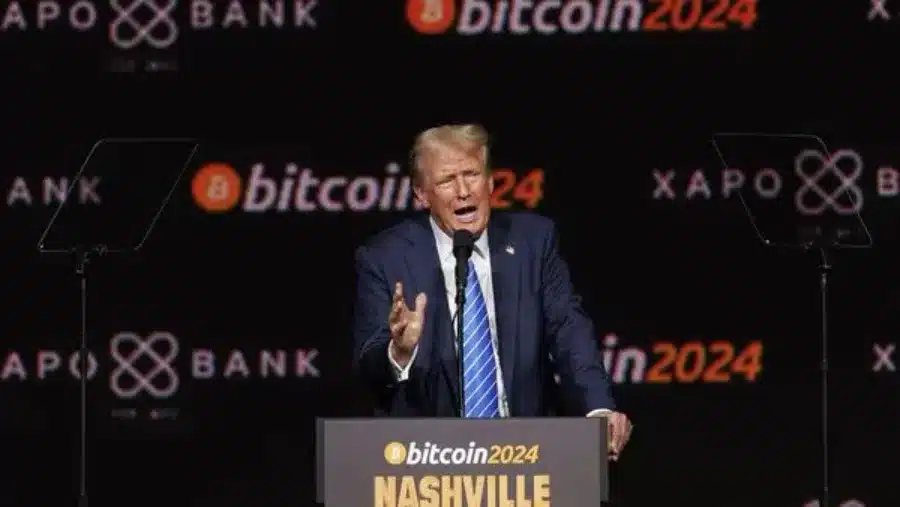

Trump speaking at Bitcoin-related event

Recent developments impacting the market:

- President Trump established a strategic Bitcoin reserve using seized assets

- Bitcoin dropped 4% to $86,516 following the announcement

- Wall Street futures declined while safe-haven assets strengthened

- Chinese deflationary pressures affecting global markets

- Daily liquidation losses exceeding $800 million

Key considerations for investors:

- Sharp rallies historically precede steep corrections

- Governments worldwide are considering stricter regulations

- Institutional frameworks are evolving to manage crypto markets

- Experts advise caution and risk management

- Market remains highly unpredictable

While enthusiasm grows around Bitcoin's surge, the cryptocurrency's future movements remain uncertain. Investors should focus on fundamentals rather than hype, maintaining a balanced approach to risk management in this volatile market environment.

MICHAEL SAYLOR SAYS, "THE FACT THAT YOU CAN BUY #BITCOIN FOR $80,000 RIGHT NOW IS A JOKE."

IT'S AT 99% DISCOUNT 🤯 pic.twitter.com/8xTqvEZ0Fa

— Vivek⚡️ (@Vivek4real_) March 14, 2025

Related Articles

Dow Jones Closes Q1 with Market Uncertainty: March 31 Warning Signs for Investors