SoulCycle's Low Music Royalties Don't Match Their $112M Revenue From Music-Driven Classes

SoulCycle relies heavily on music for its business model, yet pays surprisingly low royalty rates to music creators through performing rights organizations (PROs). The fitness company's own SEC filing describes music as essential to their "carefully curated 'cardio party'" experience.

The company generates significant revenue - nearly $112 million in 2014 across 36 locations, with projections reaching $775 million as they expand to 250 locations. Despite this success and 23% profit margins, their music licensing fees are minimal.

Concert crowd with raised hands

Current Licensing Structure:

- BMI's maximum annual fee per location: $2,123

- This represents only 0.01% of a single location's revenue

- ASCAP uses similar flat-fee structure per location

- Fees don't account for SoulCycle's premium pricing or music-centric business model

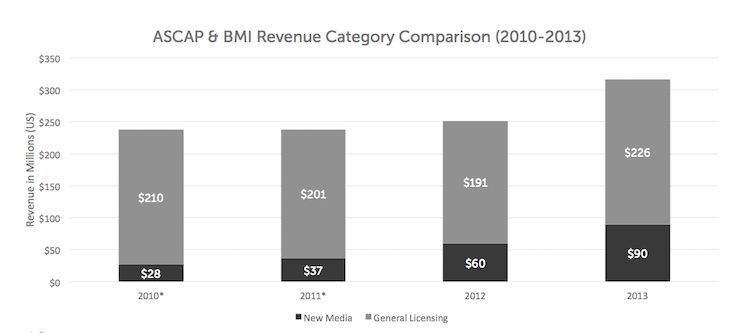

Bar graph of music revenue comparison

Distribution Problems:

- PROs don't track actual songs played in classes

- Revenue is distributed using inaccurate proxies like radio play data

- System favors "Top 40" hits over niche genres commonly used in classes

- Technology exists for accurate tracking but isn't being utilized

Line graph: Spotify artist earnings trend

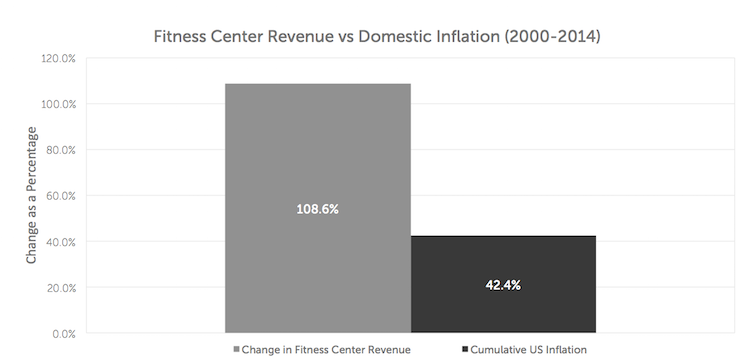

Industry Growth:

- Fitness center revenue increased 104% in the US (2000-2014)

- SoulCycle's growth: 108% from 2012-2013

- Further 49% growth from 2013-2014

- Far outpaces domestic inflation (48% growth in same period)

Solutions Needed:

- Update licensing fee structures to reflect current market value

- Implement modern tracking technology for accurate royalty distribution

- Adjust distribution methods to better serve all music creators

- Recognize the true value of music in fitness-based businesses

The responsibility lies with PROs to modernize their approach and ensure fair compensation for songwriters whose music drives these successful fitness enterprises.